The Basic Principles Of How Does Medigap Works

Wiki Article

Some Known Questions About How Does Medigap Works.

Table of ContentsWhat Does What Is Medigap Do?Not known Facts About Medigap BenefitsThe Of How Does Medigap WorksThe 25-Second Trick For MedigapNot known Facts About What Is Medigap

You will need to consult with a certified Medicare representative for rates and also schedule. It is very suggested that you purchase a Medigap plan during your six-month Medigap open enrollment duration which begins the month you transform 65 and are signed up in Medicare Component B (Medical Insurance Policy) - Medigap benefits. Throughout that time, you can get any type of Medigap policy marketed in your state, even if you have pre-existing problems.You might have to buy a much more pricey policy later on, or you could not have the ability to acquire a Medigap plan whatsoever. There is no guarantee an insurance business will offer you Medigap if you make an application for protection outside your open enrollment duration. When you have made a decision which Medigap plan fulfills your requirements, it's time to discover which insurance business sell Medigap policies in your state.

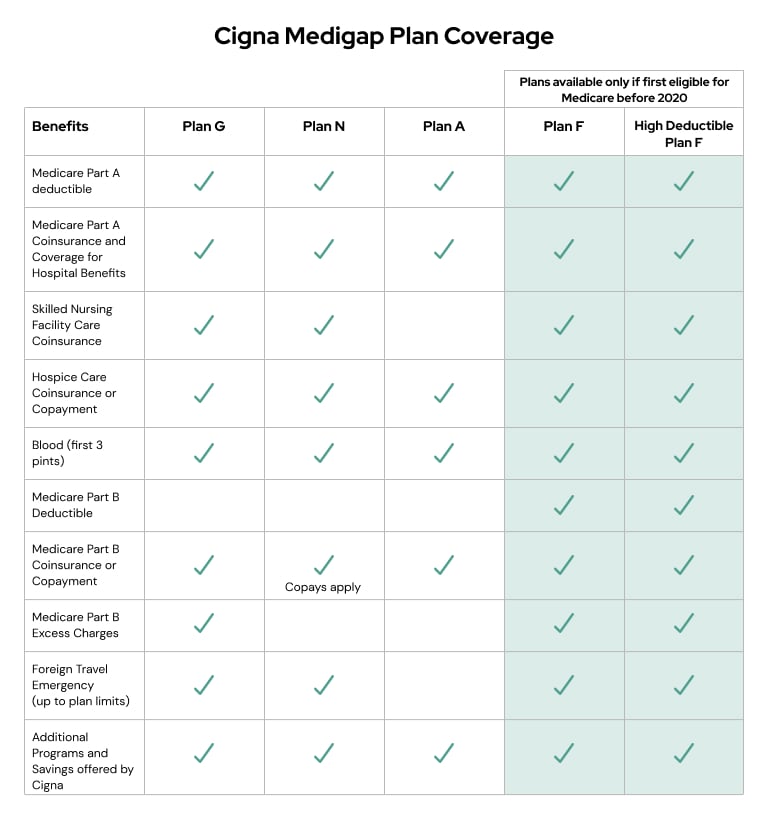

Called Medicare Supplement, Medigap insurance prepares assistance fill up in the "gaps" in Original Medicare by covering a part of the out-of-pocket prices Over after Medicare Part A and B coverage. The precise insurance coverages depend on the kind of strategy that is purchased as well as which specify you stay in.

Called Medicare Component C.

With Component B, Medicare usually pays 80% and also the person pays 20%. With Part A, there's an insurance deductible that uses to each advantage period for inpatient care in a health center setup.

Getting My Medigap Benefits To Work

If you need health care services while taking a trip outside of the USA, it is very important to comprehend that Original Medicare does not cover emergency healthcare services or materials beyond the U.S. Nonetheless, there are some things that Medicare supplement insurance policy normally does not cover, such as vision or dental care, spectacles, hearing help, private-duty nursing, or long-lasting treatment.:max_bytes(150000):strip_icc()/Primary-Image-best-medicare-supplement-insurance-companies-5074131-b8173416119a44449aefb83d7996f791.jpg)

Medigap plans could aid you minimize your out-of-pocket health care expenses so you can obtain cost effective therapy for thorough health care during your retired life years. Medicare supplement strategies may not be right for each circumstance, but recognizing your options will certainly help you decide whether this kind of protection can assist you manage healthcare prices.

Reporter Philip Moeller is here to supply the responses you need on aging as well as retirement. His once a week column, "Ask Phil," intends to help older Americans as well as their family members by addressing their health treatment as well as monetary inquiries. Phil is the author of "Get What's Yours for Medicare," as well as co-author of "Get What's Yours: The Modified Keys to Maxing Out Your Social Protection." Send your concerns to Phil; and also he will respond to as several as he can.

Everything about Medigap

The most significant void is that Component B of Medicare pays just 80 percent of covered costs. Most likely, even more people this would acquire Medigap strategies if they could afford the monthly premiums. Virtually two-thirds of Medicare enrollees have fundamental Medicare, with regarding 35 percent of enrollees instead picking Medicare Advantage plans.

Unlike other private Medicare insurance strategies, Medigap strategies are regulated by the states. And also while the specific coverage in the 11 various types of plans are dictated by government regulations, the prices and schedule of the strategies depend on state rules. Federal rules do give ensured problem civil liberties for Medigap purchasers when they are new to Medicare and also in some situations when they switch in between Medicare Advantage and also basic Medicare.

Nevertheless, once the six-month duration of government mandated civil liberties has passed, state regulations take over determining the legal rights individuals have if they desire to buy new Medigap plans. Here, the Kaiser table of state-by-state guidelines is invaluable. It must be a mandatory stop for any individual thinking of the function of Medigap in their Medicare strategies.

The Facts About Medigap Benefits Revealed

I have not seen tough information on such conversion experiences, and also on a regular basis tell readers to test the market for brand-new policies in their state prior to they change right into or her response out of a Medigap plan during open registration. I think that anxiety of a possible issue makes many Medigap insurance holders resistant to alter.A Medicare Select plan is a Medicare Supplement plan (Plan A via N) that conditions the settlement of benefits, in entire or partly, on the usage of network service providers. Network companies are providers of health treatment which have participated in a created arrangement with an insurance firm to provide advantages under a Medicare Select plan.

Report this wiki page